Portfolio diversification calculator

You need to enter your current age level of risk you can take from very low to very high investment horizon in years and the choice from mid small and large companies. Risk contributions volatility beta value at risk VaR maximum drawdown correlation matrix and intra-portfolio.

Investment Allocation And Diversification Calculator Kocaa

When these ETFs are combined into a portfolio.

. By combining our equity underlying hedge and income components we believe the DRS is a better way of implementing a truly diversified strategy. Its not just stocks vs. Second provide either the amount invested OR the number of shares you hold in each stock - then click.

First add stock to your portfolio real or fictional by entering stock ticker symbol. Mean Variance Optimization Find the optimal risk adjusted portfolio that lies on the efficient. The volatility for each component is summarized in Figure 2 and the average of these volatilities is 228.

Calculator The calculator below provides key investment portfolio risk metrics. To learn more about. Answer three quick questions below.

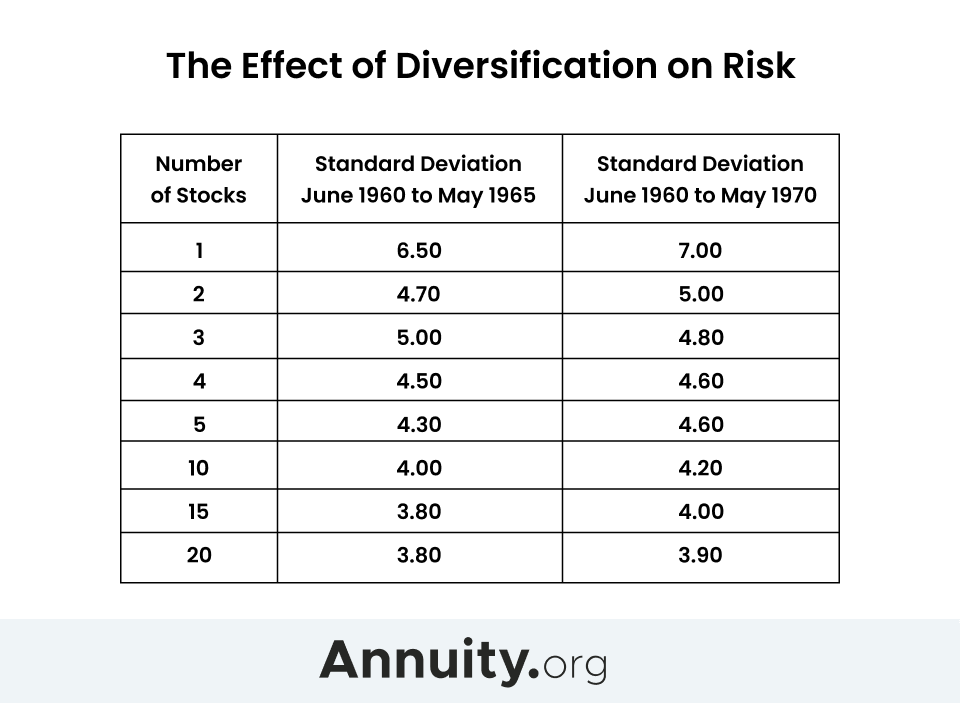

The Diversification Quotient If the portfolio consists of N loans of equal size then the concentration ratio is 1N. Buy at least 25 stocks. Diversification is a portfolio allocation strategy that aims to minimize idiosyncratic risk by holding assets that are not perfectly positively correlated.

Correlation is simply the. With a concentra- tion ratio of 50 the example portfolio has the. This portfolio optimizer tool supports the following portfolio optimization strategies.

When most people think about a diversified investment portfolio. When allocating to diversifiers from equities as represented by the SP 500 TR index the tool shows that the resulting portfolios historically generated higher returns and lower risk in the. Investing Calculators Tools Our investing tools can help you review your current strategy and maintain a portfolio with investments that fit your needs.

Diversification Calculator Wealth Management Through Diversification We diversify investment portfolios in markets and industries across the world Try Our Diversifier Our Diversification. Risk Reward for Portfolio 1. Here are some important tips to keep in mind to help you diversify your portfolio.

MPT shows that by combining more assets in a portfolio diversification is increased while the standard deviation or the volatility of the portfolio is reduced. Diversification Calculator Diversification is a technique that reduces risk by allocating investments among various fund categories. Here are three tips to make it easy for beginners to diversify.

Building a diversified portfolio can seem like a daunting task since there are so many investment options. 800-343-3548 Chat with a.

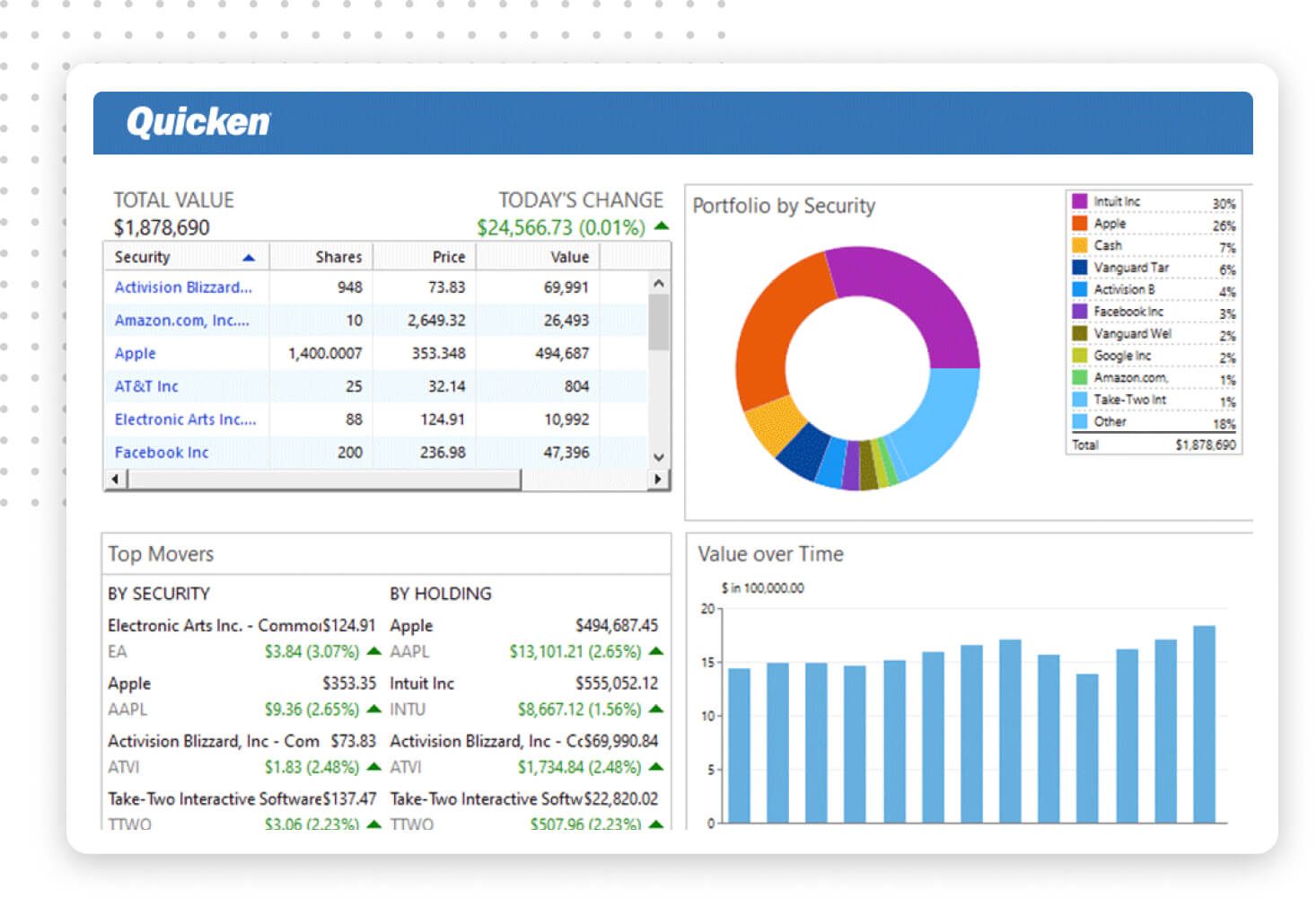

Quicken Investing Management Software Track Your Investments Today

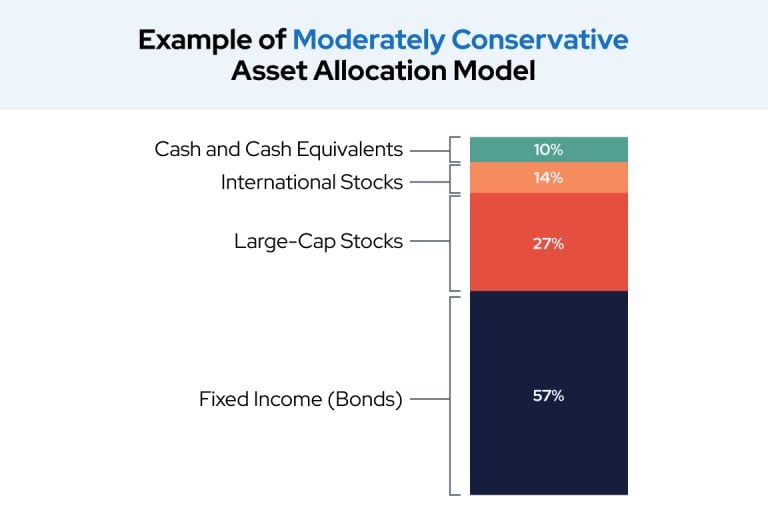

Asset Allocation The Ultimate Guide For 2021

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

What Is Asset Allocation How Is It Important In Investing

The Proper Asset Allocation Of Stocks And Bonds By Age

Asset Allocation Calculator Cnn Learning How To Invest Money

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Asset Allocation The Ultimate Guide For 2021

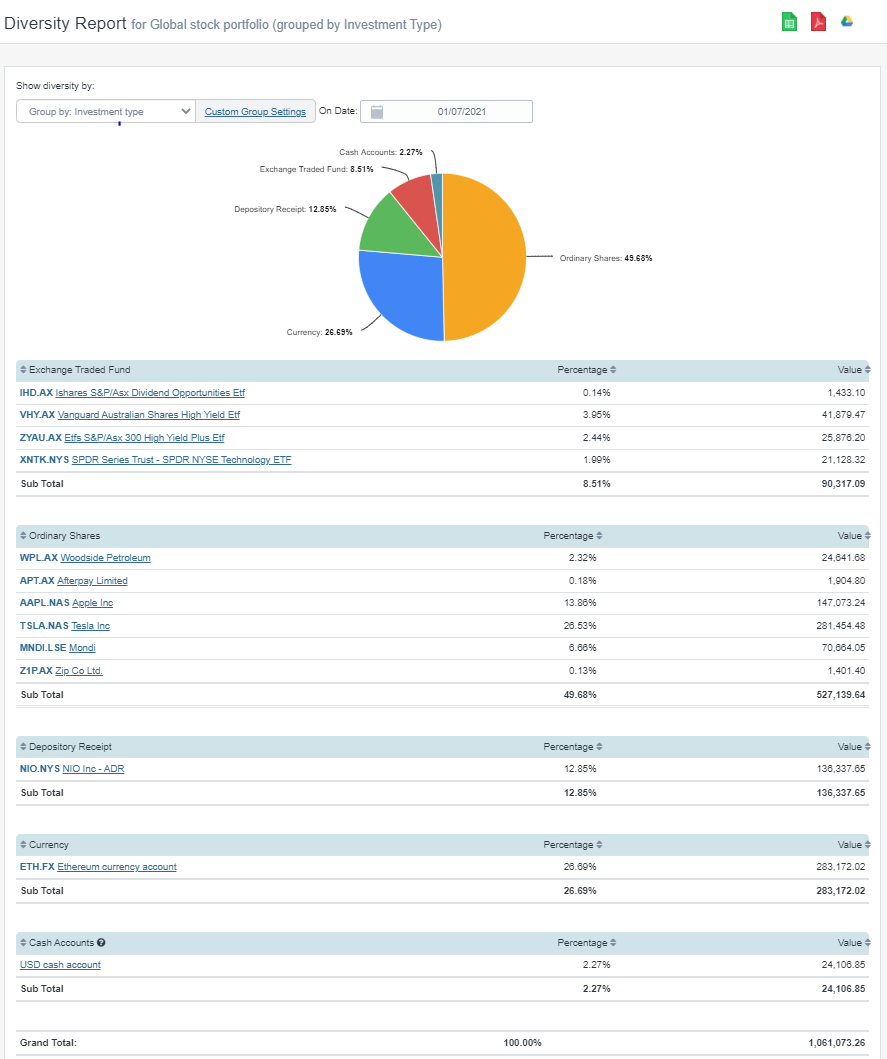

Calculate Your Investment Portfolio Diversification With Sharesight

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Expected Return Of A Portfolio Formula Calculator Example Calculate Online

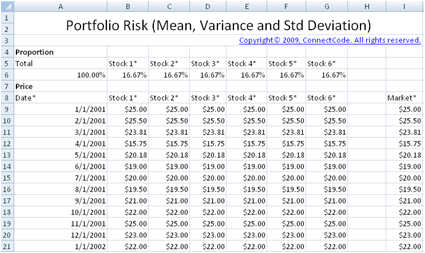

Free Modern Portfolio Risk Mean Variance Standard Deviation Covariance Beta And Correlation

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Diversification How To Build A Diversified Portfolio

Asset Allocation Calculator Investonline

Calculate Your Investment Portfolio Diversification With Sharesight

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money